free cash flow yield calculator

Gross cash flow is money collected from rent and extra services such as application fees late fees or renting appliances to a tenant. Understanding your APY can help you determine how your money will grow over a year and make smart decisions about your.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

It measures the liquidity available to investors.

. 50000 per year for 5 years. View WMT net cash flow operating cash flow operating expenses and cash dividends. Using this tool enter an investment property purchase price and rent per week or month and you will see the annual rental yield.

A Acquired machinery for 2 50000 paying 20 by cheque and executing a bond for the balance payable. For example when a government or local. Rental yield calculator For property investment.

To understand the difference it may help to imagine a cake. What is free cash flow. The other cash flows will need to be discounted by the number of years associated with each cash flow.

Importance of Free Cash Flow. This starts the Cash Flow Register when you enter your initial investment. If a bond is quoted at a discount of 86 enter 86 here.

The calculator should show CF1. Will calculate the Current Price. Free Cash Flow 550 million 100 million 175 million.

You may have heard the terms levered free cash flow and unlevered free cash flow. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis. Annual yield is your annual income for the property as a percentage of the cash you had to invest to buy it.

When opening savings checking or investment accounts you may see your financial institution list an APY. Compounding Times per period - The calculator uses the compounding factor for the interest earned which means your interest earns interest. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time.

In property investing the annual rental yield that you receive from your investment property is one of the most important factors in determining your total return. Free cash flow measures the cash a company generates from business operations after they subtract capital expenditures. Ideally net cash flow from a rental property is always positive.

All this cash can be further invested in the growth of the company or can be paid a dividend. Plugging the above cash flows into the IRR Calculator will reveal that my offer would yield a 299 average annual rate of return. The volumetric flow rate which is also commonly referred to as the rate of liquid flow or volume flow rate is the volume of a given fluid that flows within a unit of timeIt is usually denoted by the Q symbol.

This provides a steady influx of cash over the life of the bond which can be invested in other securities or used as retirement income. Beginning to be selected if you are expecting the cash flows at the. Free Cash Flow 275 million.

Free Cash Flow to Equity is an alternative to the Dividend Discount Model for estimating the value of a firm under the Discounted Cash Flow DCF valuation model. Bond price - while bonds are usually issued at par they are available in the resale market at either a premium or a discount. Explanation of Free Cash Flow Formula.

Back to Calculator Back to Calculator Back to Net Present Value Calculator Back up to Net Present Value NPV Calculator. How to Use the Bond Calculator Your inputs. For each of the following transactions calculate the resulting cash flow and state the nature of cash flow viz operating investing and financing.

The formula for net cash flow can be derived by using the following steps. The formula is relatively easy to get down. Because cash is paid out its a negative number.

Dividend Discount Model of valuation can be used only when a firm maintains a regular discount payout. Press the Cash Flow CF Button. Subsequent cash flows.

Hence the Free Cash Flow for the year is 275 Million. In this example enter -150000 and hit enter. L ong-term G rowth Rat e This is a term financial analysts use to predict the rate at which a company will grow in the long-run.

The compounding occurs needs to be entered here. Annual cash flow by MarketWatch. The rate at which a liquid flows will vary according to area of the pipe or channel through which it is passing and the velocity of the liquid.

For each cash flow in the schedule of cash flows. Leave your real estate worries on the incredible shoulders of expert real estate agents in Liverpool. We discount our cash flow earned in Year 1 once our cash flow earned in Year 2 twice and our cash flow earned in Year 3 thrice.

Cash flow is the amount of money an investment generates each month through rent after the propertys expenses are considered. The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. What is Volumetric Flow Rate.

Press the Down Arrow Once. Connect with Community First Real Estate leading real estate agency in Liverpool. Subtract the operation costs and mortgage payment from the total rental income value.

Select the month and day and enter the 4-digit year of the date of the cash flow. Firstly determine the cash flow generated from operating activitiesIt captures the cash flow originating from the core operations of the company including cash outflow from working capital requirements and adjusts all other non-operating expenses. Free Cash Flow FCF is a measure of your companys financial performance which can be calculated by deducting capital expenditures from the operating cash flow.

Tap the Save button to add the cash flow to the calculator. Free cash flow is a very important tool for investors. Select the direction of the cash flow Out for investments In for withdrawals.

The higher the free cash flow the more cash-rich the company is. Free Cash Flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and working capital for the year. Unlevered cash flow is the cake when its whole.

Net cash flow is the amount of money left over at the end of each month after the rent has been collected and all of the bills have been paid. View TSLA net cash flow operating cash flow operating expenses and cash dividends. Cash flow of each period - Here you need to select the point of cash flow.

APY stands for annual percentage yield. For example if you invested 20000 of your own cash and earn 2000 a year in net cash flow thats a 10 annual yield also known as cash-on-cash return. If you enter a 0 zero and a value other than 0 for the Yield-to-Maturity SolveIT.

Tax Exemptions Specific types of bonds can provide a tax advantage to investors. Enter the amount of the cash flow. Annual cash flow by MarketWatch.

Cash Flow Bonds pay interest at set intervals usually annually or biannually. The best cash management accounts should offer several features including a debit card free ATM access unlimited check writing and easy accessibility either via a mobile app or online portal.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow And Fcf Yield New Constructs

What Is Free Cash Flow Yield Definition Meaning Example

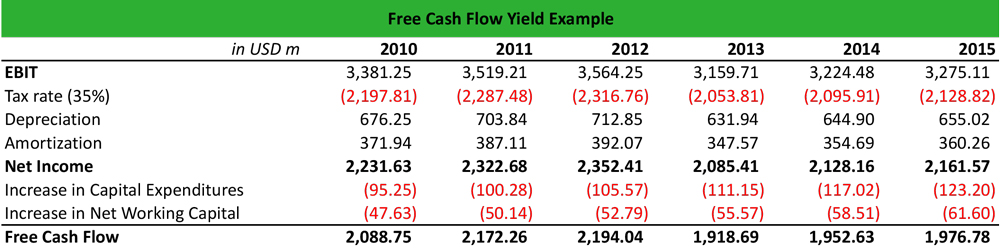

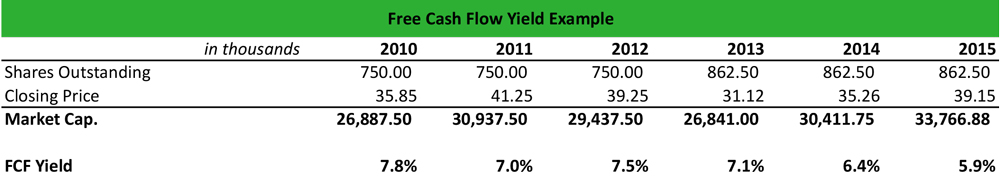

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

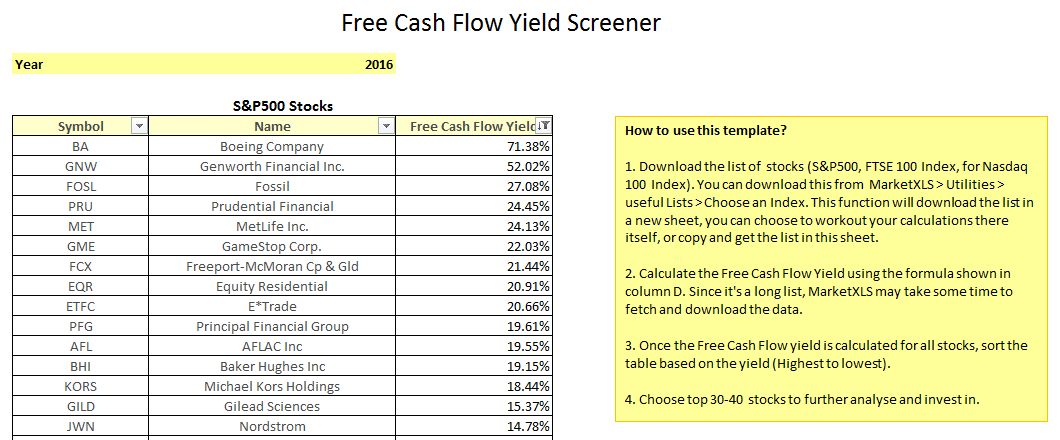

Fast Free Cash Flow Yield Screener For S P 500 Stocks Using Marketxls Template Included